Vietnam among three real estate hotspots in Asia

Ho Chi Minh City, Vietnam. (Photo: Internet)

Global real estate markets are being affected by the US and European economies' rising inflation and recessions, and the Asia-Pacific region is not immune to the same factors that are wreaking havoc in other areas.

There are, however, pockets of optimism spread throughout the area due to the region's higher development potential and the sheer diversity of its businesses and cities. Three of these—Vietnam, Singapore, and Japan—are highlighted by Savills Prospects.

|

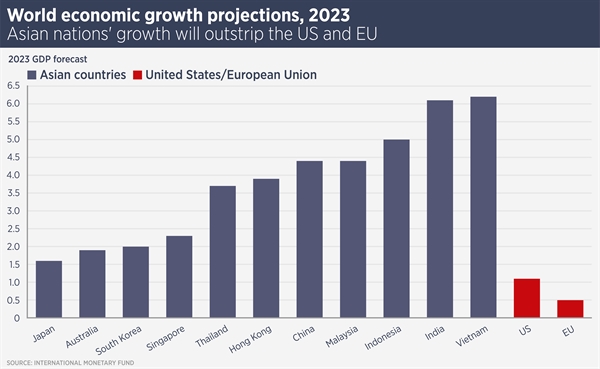

| Savills predicts Vietnam to lead global growth with the highest growth rate in 2023 (Photo: Savills) |

In 2023, emerging Asian economies like China, Vietnam, Indonesia, and India are expected to drive global growth; even the developed economies of Australia and Japan are expected to expand more rapidly than the US and EU.

Foreign investors' interest in the Vietnamese real estate market is increasing thanks to rising FDI and governmental reforms.

Although tighter lending constraints are making life tough for some local developers, foreign money is still active.

Additionally, according to Savills statistics for the third quarter of this year, Hanoi and Ho Chi Minh City's CBD office and retail rents are increasing.

Manufacturers investing in the industrial and logistics sector do so to diversify their business operations as part of a "China-plus" strategy.

With rising FDI and a strong domestic economy, Vietnam is on track for development in 2022.

According to Troy Griffiths, Deputy Managing Director of Savills Vietnam, “The Vietnamese government is also introducing a series of measures to improve real estate transparency, which bode well for future liquidity and investability. It is also investing in infrastructure. We are seeing continued investor interest in a number of sectors.”

Same category news

Latest news

-

Huyen Hoang

TIẾNG VIỆT

TIẾNG VIỆT

_291615658.jpg)