Central banks continue to bolster gold reserves

Photo: Reuters.

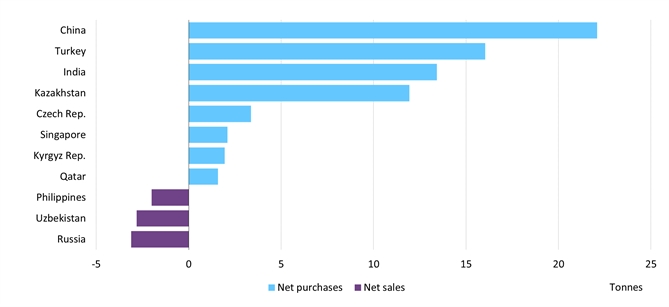

China’s central bank dominates the gold market

According to the World Gold Council (WGC), gold reserves of global central banks increased by 19 tonnes in February. Purchases decreased by 58% compared to January due to some banks The central government also increased gold sales.

However, market analyst Krishan Gopaul at WGC, said that central bank gold demand remained stable in the first months of 2024. Central banks added 64 tons of gold in January and February, down more than 43% compared to the same period in 2023 but increased 4 times compared to 2022.

The People's Bank of China continued to dominate the gold market when it bought 12 tonnes in February. Including February, the PBoC's gold reserves have increased for 16 consecutive months, although the proportion of gold in total reserves is about 4%.

Many analysts believe that China will continue to buy gold because it wants to diversify its foreign exchange reserves away from the USD.

However, China is not the only buyer of gold. The Czech National Bank added 2 tonnes to its reserves in February. The Czechs bought a total of nearly 22 tonnes, lifting gold holdings to 34 tonnes, an increase of more than 183% compared to the end of February 2023.

In addition, the Monetary Authority of Singapore bought 2 tonnes of gold in February. The National Bank of Kazakhstan increased its gold reserves by 6 tonnes, continuing its strong start to 2024. The Reserve Bank of India also showed its gold reserves rose by 6 tonnes in February.

|

| Photo: WGC. |

Why are central banks buying gold?

Indeed, WGC also highlights the enduring value of gold, emphasizing its role in crisis management, asset diversification, and value preservation.

In addition, in 2024, the world still faces many political and economic uncertainties. In that context, increasing gold ownership could be a suitable strategy for investors looking to protect their portfolios against heightened uncertainties

Gold has historically been considered a haven asset in the reserves of central banks globally, due to its safety, high liquidity, and profitability. These are the three basic investment objectives of central banks. Therefore, the proportion of gold held by central banks globally is estimated to be around 20% of the total gold mined.

Ryan Mclntyre, Director of the company Sprott Asset Management in a recent interview with Kitco News said "I think central banks will continue to increase gold purchases. The currency reserves of other countries are increasingly less meaningful, in the context of a polarized and unstable world."

WGC indicates that there are only two large sellers during the month. The Central Bank of Uzbekistan sold 12 tonnes of gold in February, while the Central Bank of Jordan reduced its gold holding by 4 tonnes.

TIẾNG VIỆT

TIẾNG VIỆT