Vietnam's manufacturers brace for worse after GDP whiplash

Factories have seen orders canceled in Vietnam, the Asian country most exposed to global swings in trade after Singapore. Photo by Reuters.

This was supposed to be a good year for the fabric mesh manufacturer in Vietnam where James Lee works as a sales manager. As China relaxed its zero-COVID restrictions, businesses expected a jump in demand that would give the economy a shot in the arm.

Instead, orders are so slow at Lee's company, Daeduck Mesh Vina, which supplies fabrics for backpacks and caps, that he is looking for domestic buyers to replace the foreigners who are his usual clients.

"My customers, my competitors, many people are saying that it's worse than [during] COVID," Lee told Nikkei Asia.

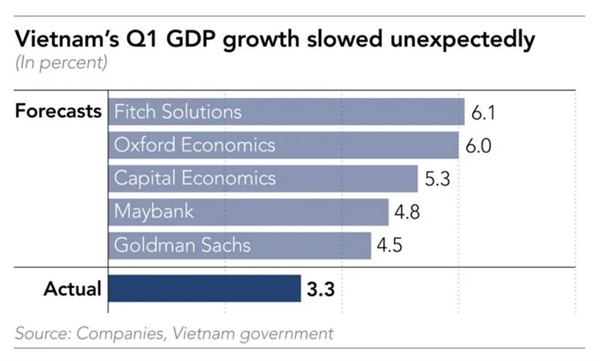

Vietnam's gross domestic product growth of 3.3% in the first three months of 2023 took many economists by surprise. The figure was far below forecasts and marked a reversal for what was recently Asia's fastest-growing economy. And while a drop in exports weighed on growth, a simultaneous dip in imports -- which are used mainly to make products for export -- indicates producers are not optimistic about a near-term recovery in global demand.

The first quarter slowdown has prompted economists to trim their full-year forecasts, citing risks such as stress in the domestic property sector and fears of a global recession hitting factory orders, the lifeblood of Vietnam's economy.

|

| Vietnam's economy grew 3.3% in the first quarter of the year, falling far short of forecasts and dashing hopes for a strong post-pandemic recovery. Photo by Reuters. |

"We think the exports slump is not over yet, as global demand continues to weaken through the year," Oxford Economics assistant economist Theng Theng Tan wrote in a note last week. "The real estate sector is also facing severe domestic headwinds from [a] credit crunch and an ongoing anti-corruption campaign."

The campaign stunned investors in the first quarter with the removal of Vietnam's president, who resigned to take responsibility for corruption scandals during his term. The wide-ranging crackdown has included arrests of state officials as well as executives in the property and banking industries.

Tan sees "more weakness to come" after the campaign "deterred investors and caused disruptions in investment approvals."

Businesses in sectors from industrial property to electronics and textiles are voicing pessimism similar to Lee's.

|

Wendy Nguyen, a salesperson at sportswear supplier Shindo, agrees that the year has gotten off to a rougher start than anticipated: Orders at her company are 20% lower, so far, than they were in 2022. "It's not about our company, it's about the market," she said in an interview about the anemic demand. "We're all surprised."

Oxford Economics forecasts 4.2% GDP growth for Vietnam in 2023, down by nearly half from the 8% expansion last year. Import declines are an especially revealing bellwether because Vietnam's imports feed mainly into exports, months later.

"This could signal that manufacturers remain pessimistic about the external demand outlook, given their caution about purchasing inputs," Maybank economists Brian Lee Shun Rong and Chua Hak Bin wrote in an analysis, noting that computer and electrical products led the 15% year-on-year import decline last quarter.

At the same time, exports dropped 12%, a decline reflected in all the leading product categories: phones and other electronics, clothes, shoes and wood products, according to Vietnam's statistics office.

|

| Trucks pass through a border crossing with China: Vietnamese exporters have expressed surprise at the lingering weakness in their sales. Photo by Reuters. |

China is the top source of imports and tourists entering Vietnam, as well as the top buyer of its exports after the U.S. But Beijing's end to COVID curbs has not been a boon to exports or travel.

Truckers had to wait a month last year to carry goods from Vietnam to China, which imposed border restrictions, including disinfecting products. That was supposed to end in January, but instead of increasing, shipments to China shrank 5.3% in January and February versus the first two months of 2022, the latest customs data show. Drivers continue to face delays at the border, such that Vietnam's prime minister asked his Chinese counterpart last week to help speed up customs clearance, a post on the Vietnamese government website said.

About 140,000 Chinese entered Vietnam in the first quarter, down from 1.3 million in the first three months of 2019, before the pandemic struck, according to the statistics office.

Exports to Russia took an even deeper dive, falling 60% in January and February compared with the year-earlier period, according to customs data. Sanctions slapped on Russia over its invasion of Ukraine are the reason, according to a local media report shared on the Ho Chi Minh City government website.

With much of this outside Nguyen's control, she is hoping for better by year's end, saying, "We just wait for the crises to disappear."

Source: Nikkei Asia

TIẾNG VIỆT

TIẾNG VIỆT

_131447820.png)