Vietnam’s inflation remains under control: World Bank

Photo: Masan

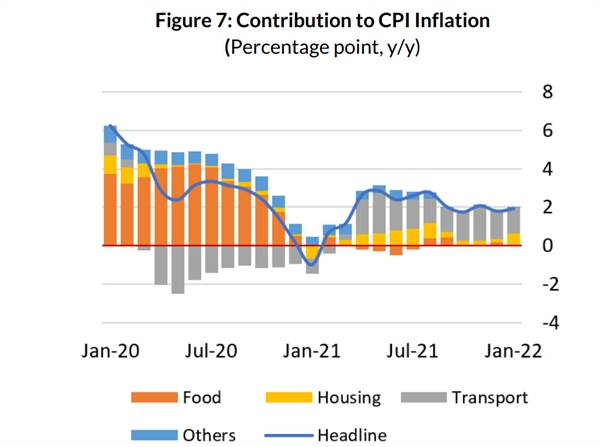

Rising energy prices continued to be the main contributor to CPI inflation as it pushed up costs of housing and transports.

Food prices remained relatively stable while core CPI, which excludes food, energy, and items whose prices are administered by the government increased by 0.7 percent.

HSBC also stated that inflation is not likely to be a big concern for Vietnam this year. In a recent report, the bank raised its prediction for Vietnam's inflation this year to 3 percent from 2.7 percent, a slight increase.

Retail has recorded a positive 1.3 percent in growth year-on-year in January alone after losing nearly 4 percent in 2021. While the 1.3 percent figure may not appear as impressive, it should be taken into consideration that January 2021's number was especially high because 2021's Tet fell in early February, giving retail a huge demand boost during the entire month.

|

| Source: World Bank |

Firms have been able to address labour shortage issues with most vacant positions filled after the holidays, setting the stage for an economic recovery.

In addition, the country's manufacturing PMI last month recorded the largest gain in the last nine months, showing a fast rebound of the industrial sector with a vast majority of indicators pointing to a strong possibility of achieving pre-pandemic industrial production levels.

Despite a slight uptick in inflation, the price for foodstuffs remained stable due to weak demand, said the report.

"A small increase in inflation (from 2.7 percent to 3 percent) for 2022 in our forecast indicates negligible risk for the State Bank of Vietnam as it remained significantly lower than the government's inflation target (4 percent)," said HSBC researchers.

"This is especially true while put in comparison with inflation forecasts for ASEAN economies such as Thailand and Singapore, where higher inflation has started to raise concerns.", they said.

Major mobility indicators rise sharply

Retail sales in January grew by 6.7 percent month-on-month and 1.3 percent year-on-year. This recovery was fueled by strengthening consumer demand, particularly for goods as households prepared for Tet celebration.

Indeed, sales of retail sales grew by 7.0 percent month-on-month and 4.3 percent year-on-year. Sales of services also increased by 5.2 percent month-on-month but was still 2.2 percent lower than a year ago.

Merchandise trade posted a surplus of 1.4 billion USD despite a slowdown in exports growth. Merchandise exports growth moderated to 8.1 percent year-on-year in January 2022 from 25.1 percent year-on-year in December 2021 while imports growth remained strong at 11.3 percent year-on-year.

This export deceleration reflected a sharp drop in exports of phones (down 26.1 percent year-on-year) and significant slowdown in other major exports, particularly computers, electronics, and machinery.

On the other hand, growth of textiles and garment exports remained strong, accelerating from 27.7 percent year-on-year in December 2021 to 34.4 percent year-on-year largely thanks to strong demand from the US.

By trading partners, exports to the US remained robust, expanding by 19.4 percent year-on-year while exports to China dropped by 15.2 percent year-on-year, reflecting the decline in exports of phones and computers to this market.

Vietnam attracted $2.1 billion of FDI commitment in January, up 4.2 percent year-on-year. Growth was driven by large investment in expansion of existing businesses, particularly in electronics and by active M&A activities. The latter doubled in value in January 2022 compared to a year ago, reaching over $400 million USD (or 20 percent of total FDI commitment).

Manufacturing continued to make up nearly 60 percent of total commitment, followed by real estates (22.5 percent). The disbursement of approved FDI projects continued to recover from their slump in the third quarter of 2021, increasing by 6.8 percent year-on-year in January 2022.

Credit growth accelerated to meet credit demand ahead of the Tet holiday, the bank said.

According to the bank, under the new Economic Recovery Support Programme for 2022-23 was launched in January 2022, overall planned on-budget fiscal measures are an estimated 4.5 percent of revised GDP. The VAT rate has been cut from 10 percent to 8 percent for most sub-sectors.

WB experts recommended that the programme should be enhanced through adding further social protection measures to support workers and households affected by the pandemic. Additionally, close monitoring of the programme implementation would help ensure its intended impact is achieved.

Vigilance on the financial sector is also warranted, given the potential impact of the crisis on the quality of bank portfolio and the spillover effects of the expected increases in interest rates by the US.

TIẾNG VIỆT

TIẾNG VIỆT