Vietnam warned over economic slowdown with less M&A deals in 2020

Cross-border acquisitions is expected to dominate M&A deals in coming years.

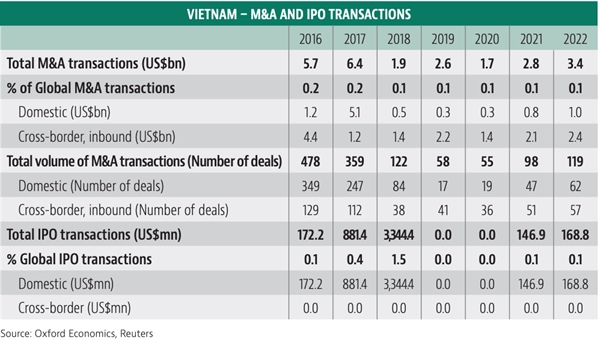

In 2019, the economy witnessed 58 M&A transactions, a reduction by 64 deals against 2018. It is expected that in 2020, total number of M&A deal could continue declining trend to 55 with total transactions of $1.7 billion

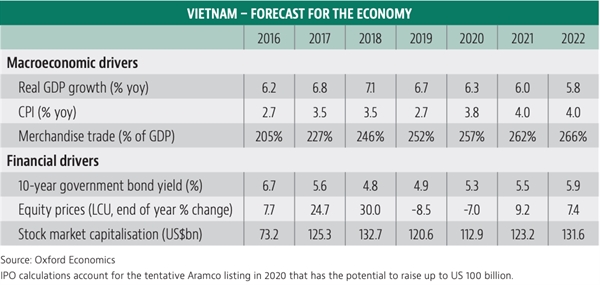

The report forecast Vietnam’s economic growth to continue to ease over the next 18 months from 6.7% in 2019 to 6.3% in 2020 and 6% in 2021, mainly due to the fact that export growth trends lower amid cooling Chinese import demand and increased global protectionism.

|

By 2022, Vietnam’s GDP growth is seen at 5.8 percent.

However, the country’s average GDP growth in the 2019 – 2022 period, is projected at 6.2%, remains higher than the global average at 2.8%, report says.

In 2019, the largest M&A deal was $1-billion investment from South Korea’s SK Group in Vietnam’s major privately-run conglomerate Vingroup, followed by a 15% stake acquisition in state-run Bank for Investment and Development of Vietnam by South Korea’s Hana Bank worth $850 million.

|

By 2021, the M&A activities could rise to $2.8 billion and $3.4 billion by 2022, in which the number of deals to increase to 98 and 119 in the 2021 – 2022.

According to Baker McKenzie’s report, there is no IPO in 2019 and 2020. The IPO market could rise by 2021 with total transaction value of $146.9 million.

TIẾNG VIỆT

TIẾNG VIỆT