South Korean investment in Vietnam grows amid U.S.-China trade war

Vingroup, in which SK Group has invested, produces smartphones among other products. © Reuters

Samsung will spend $220 million to build a research and development center in Hanoi that is scheduled to open in 2022, while SK Group has announced a decision to invest in Vingroup, the biggest conglomerate in Vietnam, for tie-ups in the automobile and other business sectors.

Direct investment in Vietnam by South Korean companies grew 10% on an approval basis in 2019 from the previous year to $7.9 billion, accounting for 20% of total foreign direct investments in the country and capturing the No. 1 position for the first time in three years.

Samsung will conduct studies on smartphones and other information technologies at the planned R&D center, according to local media. Word is circulating that the new outlet will hire 3,000 local engineers and become one of Samsung's primary R&D bases.

Samsung SDS, a systems developer of the South Korean high-technology group, purchased an equity stake of 30% in CMC Corp., the second-largest information technology company in Vietnam, for more than 4 billion yen in July last year.

|

Samsung Electronics, which has been leading South Korean investment, began producing mobile phones in the northern Vietnam province of Bac Ninh in 2009, paving the way for group companies' entry into the Southeast Asian nation. Samsung is reportedly manufacturing half its smartphones for global shipments at two plants in Vietnam.

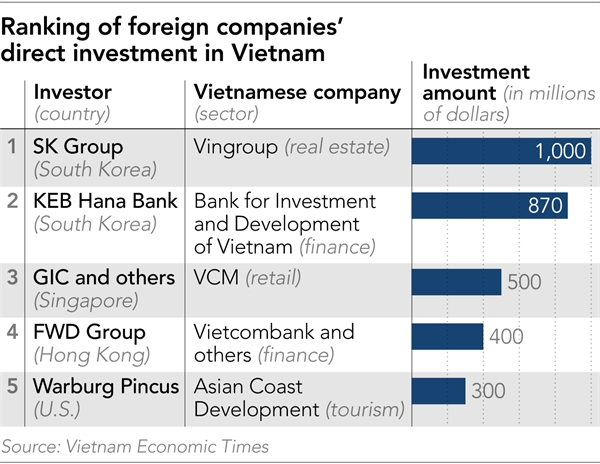

SK Group announced in May 2019 it would acquire a 6.1% stake in Vingroup for 110 billion yen. Despite the small interest, SK -- which has its forte in IT -- sees wide room for collaboration with the Vietnamese conglomerate shifting its focus to automobiles, smartphones and other manufacturing operations, analysts said.

Among nonmanufacturing South Korean companies, KEB Hana Bank signed an agreement last July to acquire a 15% stake in the state-owned Bank for Investment and Development of Vietnam for 95 billion yen.

The leading South Korean commercial bank, which has been doing business mainly with fellow Korean companies operating in Vietnam, is set to expand its client base to local companies through BIDV's branch network.

|

| Samsung, whose Galaxy Z Flip folding smartphone is seen on display in San Francisco on Feb. 11, will build a research center in Hanoi in 2022. |

Samsung, whose Galaxy Z Flip folding smartphone is seen on display in San Francisco on Feb. 11, will build a research center in Hanoi in 2022.

The U.S.-China trade war is behind South Korean companies' increasing investment in Vietnam. Exports to China, which account for a quarter of exports from South Korea, decreased 16% in 2019 from the previous year.

In addition, South Korea's trade with Japan is contracting. A consumer boycott of Japanese products followed Japan's imposition of restrictions on exports to South Korea last July, while the country's airlines have successively cut back on flights to Japan.

South Korean companies are seeking business opportunities in Vietnam at a time when their home country's economy is stagnating. Vietnam is the third largest export market for South Korea after China and the U.S. and may surpass the U.S. in 2020. Retailers selling South Korean foodstuffs and other products are growing in Vietnam having a population of 200,000 South Koreans.

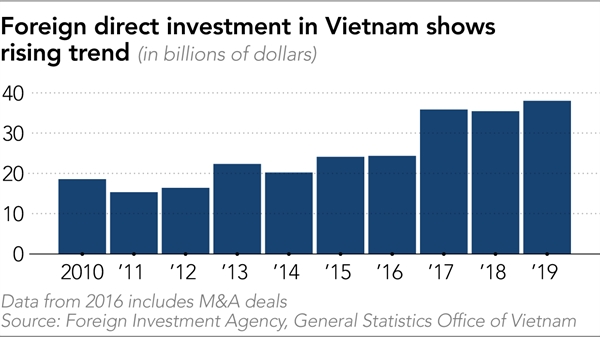

FDIs in Vietnam increased 7.2% in 2019 from the previous year to $38 billion, with Hong Kong trailing South Korea as the second-largest investor. Singapore came in third place, Japan fourth and China fifth. In 2018, Hong Kong ranked fourth, Singapore third, Japan first and China fifth.

Reflecting the trade war between the world's two largest economies, China's FDI in Vietnam jumped 65% to $4 billion in 2019 on a twofold increase in new investments resulting from Chinese manufacturers' production shifts to the country.

Japanese companies often hesitate to invest in Vietnamese businesses which tend to not disclose much information. In contrast, South Korean companies are active investors because, as a major Japanese trading house official put it, "Local outlets have discretion and so are fast in making decisions."

|

Source: Nikkei Asian Review

TIẾNG VIỆT

TIẾNG VIỆT