Govt’s draft for 49% foreign ownership cap in e-payment firms meets concerns

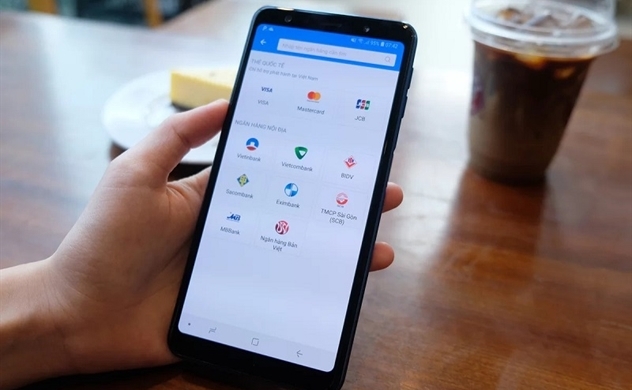

Illustrative. Photo: cellphones.com.vn

Currently, there are no restrictions on foreign ownership of e-payment firms in the country. The restriction proposal has received mixed responses from experts and fintech developers.

Policymakers suggest that the limitation on the foreign ownership ratio in Vietnam’s fintech firms could help ensuring the transparency in payment activities and facilitating fintech companies’ development.

The State Bank of Vietnam’s proposal would be applied to companies providing services related to cashless payment, including payment intermediaries, e-money, and mobile money.

However, strict control may hinder foreign investors’ motivation to join the local fintech market. Capital flow is seen to fall, affecting the development of the potential market, industry representatives told officials at Wednesday conference held by Vietnam Chamber of Commerce and Industry.

Rejecting the central bank’s proposal aiming at preventing foreign investors from manipulating this field, ensuring the safety, security, national sovereignty over its financial sector as well as fostering domestic fintech enterprises, the sectors’ representatives warned the regulation could violate international commitments.

|

| Fintech developers attend conference held by Vietnam Chamber of Commerce and Industry on Wednesday. Photo courtesy of VCCI |

“Not only investment capital, foreign investors have knowledge and technology to contribute to local e-payment firms’ development,” said Nishikawa Shinichiro, member of the Board of Directors of Payoo E-wallet.

The regulation could restrict foreign investment in this risky and potential field while the domestic capital source is not strong enough, said Nguyen Thanh Hung, chairman of the E-Commerce Association.

Phung Anh Tuan, secretary general of the Vietnam Association of Financial Investors (VAFI) , said if foreign investment is restricted, it will be difficult to tap large sources of capital, adding currently, payment intermediaries are estimated for 90% of the activities.

The VAFI leader recalled Vietnam's recent commitments on opening up the financial and banking markets. Although the “payment intermediaries" term is not mentioned in the commitment, but this activity is included in the commitment of payment services, Tuan said.

Responding to the opinions, Le Anh Dung, deputy director of central bank’s Payment Department, emphasized that the central bank has considered carefully this foreign ownership limit proposal.

“The rate of 49% is in line with international commitments, ensuring the rights of the parties,” Dung added.

"By comparing government regulations and Vietnam's commitments, the State Bank of Vietnam is confident that the concept of ‘intermediaries of payment’ is not included in international commitments,” Dung said.

Previously, the central bank had proposed a 30 percent foreign ownership limit in e-payment firms. The draft received strong opposition from local fintech companies, prompting a reevaluation by the authority.

As of end of the first quarter this year, there were 27 e-wallets in the domestic market, but 90 percent of market share were owned by only five companies. The five largest e-payment firms are owned somewhere between 30 and 90 percent by foreign investors, according to central bank.

Same category news

-

Huyền Hoàng

TIẾNG VIỆT

TIẾNG VIỆT

_1120686.png)