Vietnam, Taiwan boost share of shipments to U.S. as China loses out

An aerial view of containers and cargo vessels at China's Qingdao port in May last year. Photo by Reuters.

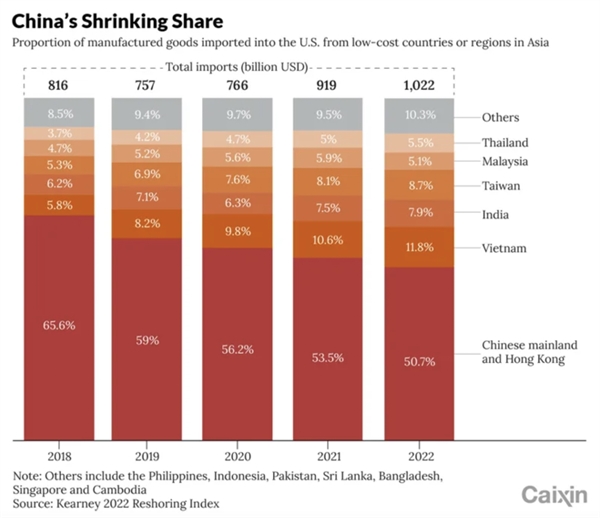

In 2022, the Chinese mainland and Hong Kong accounted for a combined 50.7% of U.S. imports of manufactured goods from the 14 Asian LCCs. The number is down from 53.5% in 2021 and continues a downward trend that began in 2013, according to the annual Reshoring Index report by management consulting firm Kearney.

The 14 Asian LCCs include the Chinese mainland, Hong Kong, Taiwan, India, Vietnam, Thailand, Malaysia, Indonesia, the Philippines, Singapore, Cambodia, Pakistan, Bangladesh and Sri Lanka.

China's share continued to decline even though U.S. imports of manufactured goods from the 14 Asian LCCs grew 11% in 2022 to more than $1 trillion, according to the report. The Chinese mainland and Hong Kong's share of U.S. exports was largely taken by Vietnam, India, Taiwan and Thailand.

There has been a shift of manufacturing away from the Chinese mainland and Hong Kong, with many companies adapting their supply chains to reduce dependence on the nation due to concerns over areas such as intellectual property, tariffs, geopolitical tensions and supply chain resilience, the report said.

|

The report also mentioned that consumer electronics companies like Apple and Samsung Electronics have shifted production away from the Chinese mainland and Hong Kong and expanded in Vietnam and, most recently, India to diversify their supply chains. To attract the moves, governments of the Asian LCCs have also been focused on building infrastructure and offering incentives to create their own industry ecosystem.

Among Apple's top 200 suppliers, the number of companies setting up plants in Vietnam increased from 17 in 2018 to 23 in 2020, including seven Chinese mainland companies, according to a May report from Everbright Securities.

A similar trend was noted in the apparel and textile industry, with the report stating that increasing labor costs, supply chain bottlenecks and social concerns have accelerated the industry's move out of the Chinese mainland and Hong Kong and into other Asian LCCs, according to the report.

The nation's manufacturing exodus is likely to benefit some of the traditionally less industrialized nations, such as Cambodia. Last year, Cambodian authorities announced plans to expand its automotive and electronics industries by investing more than $2 billion in the next three years, the report said.

Between 2018 and 2022, Cambodia's electronics exports to the U.S. grew at a compound annual growth rate of 128%, albeit from a very small base, the report said, adding that the country, along with Thailand, Vietnam and India, is one of the early beneficiaries of the move of semiconductor manufacturing away from the Chinese mainland and Hong Kong.

Moving manufacturing to Mexico and the U.S.

According to the report, some companies -- especially those looking to save on logistics and transportation for larger, bulkier consumer products that have relatively low value density -- are diversifying from Asia altogether and moving to Mexico and the U.S. As an example, the report cited furniture assembly, which is increasingly being done in Mexico, a trend prompted by Chinese manufacturers setting up operations in China-focused industrial parks that have emerged near the Mexican city of Monterrey and other cities close to the border.

Returning manufacturing to the U.S. has become increasingly important to companies, the report said, adding that more than 80% of companies surveyed across almost all industries indicated they plan to move at least part of their manufacturing operations back to the U.S. in the next three years. Some of these companies operate in industries that are being incentivized by the U.S. government's Inflation Reduction Act and the CHIPS Act, which target the electric vehicle industry and semiconductor industry, respectively.

However, the report said that chemical companies, particularly those involved with base chemicals, may face difficulties bringing manufacturing back to the Western world due to environmental and cost concerns. The base chemicals industry, which saw a shift out of the Chinese mainland and Hong Kong during the COVID-19 pandemic, could increasingly become reliant on the Asian nation again.

Source: Nikkei Asia

TIẾNG VIỆT

TIẾNG VIỆT

_131447820.png)