Vietnam grapples with shrinking exports, power crunch

Textile and apparel companies display goods at a trade show in Ho Chi Minh City: Manufacturers are grappling with weaker foreign demand and domestic turmoil. Photo by Lien Hoang.

One of Asia's fastest-growing economies in recent years, Vietnam's gross domestic product expanded 8% in 2022, with global companies investing in the country as an alternative production base to China. It also benefits from a young, growing consumer market.

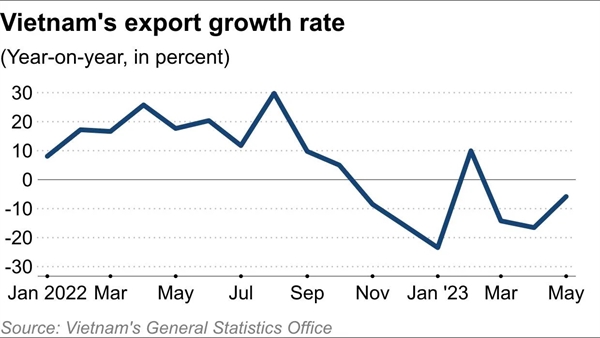

But recent data clearly show the economy is slowing. The January to May period saw declines of 11.6% in exports, 17.9% in imports and 2.5% in manufacturing versus the year-earlier period, according to the country's statistics office. The country's GDP growth slowed to 3.3% on the year in the first quarter of 2023, down from 5.9% in the fourth quarter of 2022.

The government is due to release second quarter figures later this month.

Multiple economists have downgraded the country's economic outlook. Standard Chartered now predicts Vietnam's GDP will expand 6.5% cutting its forecast from 7.2%. Oxford Economics, which had forecast a relatively weak 4.2% expansion this year, revised it down to 3.0%.

Vietnam is monitoring how demand for its products may decline among key customers like Europe and North America, where online shopping fell after COVID lockdowns ended, and where interest-rate hikes could further dent consumption. Reopening in another key market, China, has yet to be the boost Vietnam anticipated, though supply chains and travel are returning to normal.

"We were a bit too positive at the beginning of the year," said Giang Nguyen, sustainability manager at local shoemaker Biti, which faces lukewarm demand abroad. "Everybody is sitting on the edge of their chairs at the moment," she said, adding that she was also surprised by slowing domestic orders.

Foreign countries' sluggish demand "remains the biggest downside risk to growth," with Vietnam "particularly sensitive to a U.S. economic slowdown," as the U.S. buys 30% of its exports, HSBC said.

|

"With the approaching summer holidays and potential easing of visa restrictions, which are under consideration by the National Assembly, Vietnam will likely see a punchier boost from international tourism, a much-needed support for its sharply slowing economy," HSBC economist Yun Liu and associate Jun Takazawa said in a research note.

"Vietnam is not out of the woods yet," though, the bank said, adding, "There is no clear sign that Vietnam is bottoming out amid intensifying headwinds to growth."

There are domestic risks as well, including energy. Blackouts stemming from high temperatures that caused tight power supplies are hitting business operations in the country. Moreover, stalled debt talks threaten to shut down the Southeast Asian country's biggest oil refinery.

Political tremors have died down since January, when the ouster of the president and other leaders triggered fears of economic instability. But the yearslong corruption crackdown behind those dismissals still reverberates. Real estate activity, especially, slowed after several industry executives were arrested for allegations including bond violations, unnerving investors and dampening financing.

Investment approval procedures for companies have also become more stringent, which may have affected investment inflows. According to the Ministry of Planning and Investment, the amount of approved foreign direct investment this year through May 20 was $10.86 billion, 7% lower than a year earlier.

As economic worries make it hard for companies to roll over debt, nearly half the $10.7 billion in corporate bonds due in the last three quarters of 2023 are at risk of default, of which more than 80% are in real estate, according to Vietnamese rating agency VIS.

Last month, Deputy Prime Minister Tran Luu Quang told Nikkei's Future of Asia forum in Tokyo that his country will see "real benefits" from state investments by the fourth quarter of 2023, despite pressure from higher global interest rates. "We are accelerating investment to the public sector ... to compensate for some of the areas the private sector can't cover," Quang said.

Source: Nikkei Asia

Same category news

Hot news of the day

Latest news

-

Hong Thu - Bao Han

Ms. Luu Bao Huong, Chairwoman of GG Corporation: Logic guides, the heart ...

TIẾNG VIỆT

TIẾNG VIỆT

_131447820.png)