Would 900 be the likely bottom of Vietnam's benchmark VN-Index?

Photo: Quy Hoa

After Tet Lunar New Year Holiday, fears from the novel coronavirus epidemic triggered a market sell-off that pressed the VN-Index dropped by nearly 100 points to below 900 points several times.

However, every time, as a rule, when the index dropped below 900, the index recovered on that day or the next few days. For the first time in nearly 10 years, VN-Index surpassed 900 points on November 20, 2017.

Shortly after a half month, the index dropped to 900 for the first time. At that time, experts at some securities company said that it was just a "down adjustment" after a series of days of continuously increasing.

Actually, after that, this index entered a series of strong days to conquer the old peak of the era of 1,200 points. Then, frightening events related to the war, the announcements of tariffs between the US and China from June 2018, the shock of oil prices falling at the end of 2018.

These events made bad days for global stocks market. Almost during the fourth quarter of 2018, the US, Asian and Vietnamese stock markets had a very ugly performance with sharply drop following the shock of oil prices.

Dow Jones index of United State lost 18%, Japan’s Nikkei Japan lost 20%, and Vietnam’s VN-Index did stand outside the general trend and came back below 900 points twice.

|

| An investor monitors share prices on an electronic board at a local securities trading floor. Photo by AFP |

Totally, that quarter, VN-Index crashed 15% from the highest level. After a better year of 2019, the 900 level was challenged once again on March 3, 2020, two days after the stock market opened after the Tet Holiday, the COVID-19 flu triggered a sell-off, pressed the VN-Index sometimes lost nearly 100 points to below the 900 mark in just 3 trading days, taking away nearly $15 billion of market capitalization before recovering.

Most of the declines are due to macroeconomic news affecting the stock market as well as investor sentiment. In the previous declines, when VN-Index reached 900 points, experts all assessed that the market's valuation is quite low compared to the profit growth potential of companies on the floor.

This time, on March 3, 2020, the VN-Index once again broke the level of 900 but rebounded back to this level right that day and was trading in the area of 900-940 points. Like previous times, financial institutions and securities companies also evaluate this as an attractive price area compared to the profits of listed companies in 2020.

Specifically, the banking industry with forecasted profit growth of most securities companies is 20-30%. Rong Viet Securities Company reported that in the Top 50 listed companies with the largest capitalization, the profit of the banking industry will remain high while the real estate industry is expected to be higher in 2020, major contributions from Vietcombank and Vinhomes.

|

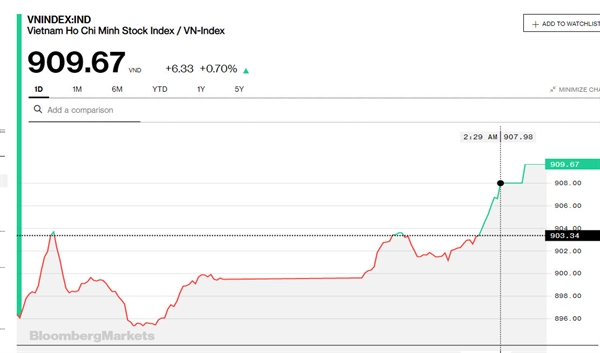

| VN-Index recovers after falling below 900 points in Feb. 25 trading day. Chart: Bloomberg |

According to Ms. Dao Phuong Thao, representative of the Financial Information Department of FiinGroup, only in the view of technical analysis, VN-Index has repeatedly decreased to 900, so it increased again. This level range is considered attractive.

However, in terms of basic fundamentals, although the VN-Index dropped quite deeply before the information about COVID-19 outbreak, the price level in comparison with profit (P/E), book value (P/B) has returned to the nearly same level as the VN-Index at about 700 points.

"The overall market at the present level is an attractive area, the reason is that the profit has continued to grow continuously but the VN-Index has not increased or decreased as mentioned above," Ms. Thao said. She also note the possibility of changes in COVID-19 if it would be out of control.

Earlier in February, the PYN Elite Fund, managing 325 million euros, assessing that although Vietnam's stock market is falling sharply due to fears of Covid-19, they still expect the market will recover soon as companies' earnings still soar like banks and retail.

|

| Vn-Index vs P/E in three recent years. Source: FiinPro |

The fund also said it bought more shares during the week of strong market declines. Later this month, Mr. Petri Deryng, Portfolio Manager of PYN announces the Vietnamese market was attractively priced even before the stock market slump caused by the coronavirus.

Vietnamese listed companies have seen good earnings growth, but the index has been consolidating and getting ready for a further take off for a couple of years now.

Same category news

-

Huyen Hoang

TIẾNG VIỆT

TIẾNG VIỆT

_131447820.png)