Phat Dat Real Estate proposed to MSCI Frontier Market 100 index

Photo: tinnhanhchungkhoan.vn

Phat Dat (HoSE: PDR) is among the two new entries to Vietnam Top 28 listed companies in the index following Kuwait’s promotion to Emerging Market category.

According to MSCI’s calculation, Vietnam’s ratio within the MSCI Frontier Markets 100 Index and MSCI Frontier Market Index could increase to 28.76 percent and 25.2 percent respectively, following Kuwait’s reduction to zero percent.

Vietnam’s current ratios in each index are 12.53 percent and 17.5 percent respectively, ranking second after Kuwait.

MSCI Frontier Market Index includes 89 stocks within the mid- and large-cap market capitalization group in 28 Frontier Market countries.

These stocks compose of approximately 85 percent of total market capitalization post-adjustments for each country’s free float rates.

Meanwhile, MSCI Frontier 100 Index includes stocks with the highest market capitalization and liquidity on the market, being selected from the MSCI Frontier Markets Investable Market Index that fulfills additional requirements for free float rates and foreign ownership room. The number of constituents of this index are only allowed ranging from 85 to 115 tickers.

Currently, iShares MSCI Frontier 100 ETF, the only ETF fund that is directly monitoring MSCI Frontier Markets 100 Index with approximate AUM of $380 million, is expected to acquire a significant quantity of Vietnamese shares, including PDR.

|

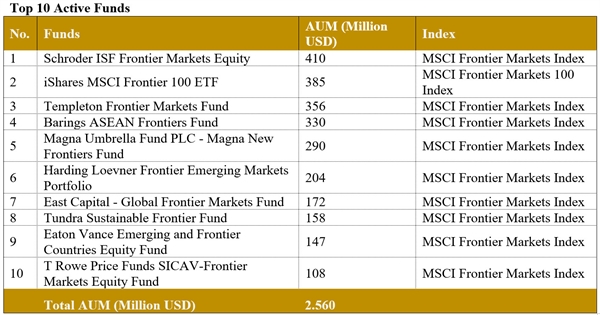

Additionally, there are many other active funds, total AUM approximately $4 billion, utilizing the MSCI Frontier Markets Index as main index of reference. Primary examples include Schroder ISF Frontier Markets Equity ($410 million), Templeton Frontier Markets Fund ($356 million), Baring International Umbrella Fund ($330 million), and Magna Umbrella Fund PLD – Magna New Frontiers Fund ($290 million).

These funds’ upcoming decision to invest into Vietnamese stocks are dependent on their respective fund manager. However, in the short term, stocks in these indices will benefit directly first.

As of October 28th 2020, the real estate firm’s market capitalization has reached VND15.625 trillion ($670 million). PDR share was traded at VND43,200 ($1.86) apiece on Wednesday.

Same category news

-

Huyen Hoang

TIẾNG VIỆT

TIẾNG VIỆT